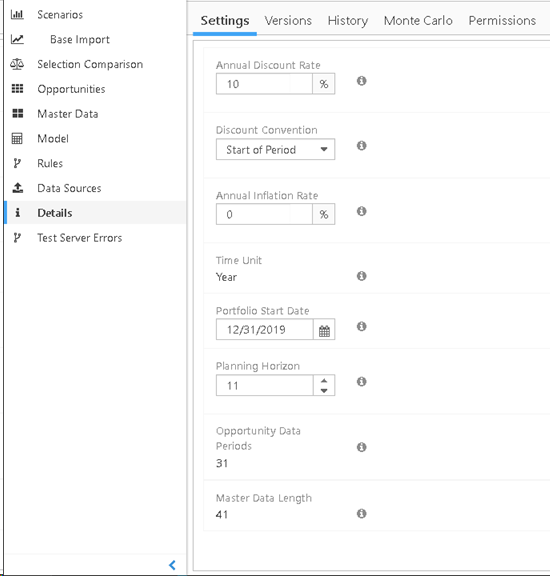

The Settings Tab

Portfolio-level settings can be managed from the Settings tab. Discount and Inflation settings only affect expressions that have been configured to use these features.

Annual Discount Rate

Expressed as a percent, the annual effective rate used by the Disc and CumDisc functions.

Discount Convention

Select one of Start of Period, Mid-Period, End of Period.

- Start-of-Period discounting assumes that all cash flows are collected at the start of the period. The first period is considered as time (0) so is not discounted but added to the discounted value of subsequent periods. These are considered at the end of the cash flow period but with a lag of a period.

- Mid-Period better accounts for the distributed nature of cash flows across a period. Discounting occurs at the mid-point of the period, I.e., cash flow for year 1 is discounted over a period of 0.5, year 2 over 1.5, etc.

- End-of-Year discounting assumes that the entire value of the cash flow for a given period comes in at the very end of the period.

Annual Inflation Rate

Expressed as a percent, the annual effective rate used by the Inf and CumInf functions.

Time Unit

The periodicity of the Portfolio calculations. This value is set on creation of the Portfolio and cannot be modified afterward.

Available options are:

- Year

- Month

- Quarter

Portfolio Start Date

The first Time Period of the Portfolio.

The first calculation period is determined by the granularity of the Time Unit, I.e., a start date of 12/31/2019 with Time Unit = Year uses 2019 as the start date, not 2020.

Planning Horizon

The number of periods that are to be considered in Optimization.

- The maximum value for Planning Horizon is determined by Opportunity Data Periods and Master Data Length.

- Max Planning Horizon <= 1+Master Data Length – Opportunity Data Periods

Opportunity Data Periods

A display-only value determined by the Opportunity data loaded in the Portfolio. The length of the longest set of Opportunity series data.

Master Data Length

A display-only value determined by the Opportunity data loaded in the Portfolio. The length of the shortest set of Master series data.

- There must be enough Master Data to cover the maximum period an Opportunity can be selected and run to completion.

- Master Data Length >= Planning Horizon + Opportunity Data Periods-1

- For instance, if a project is selected in year 11 and it has 31 years of data, results series will begin in year 11 and end in year 41.

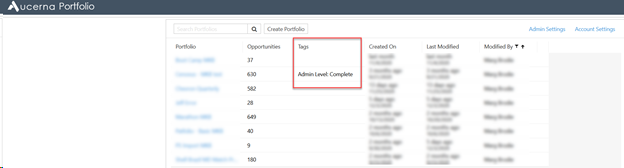

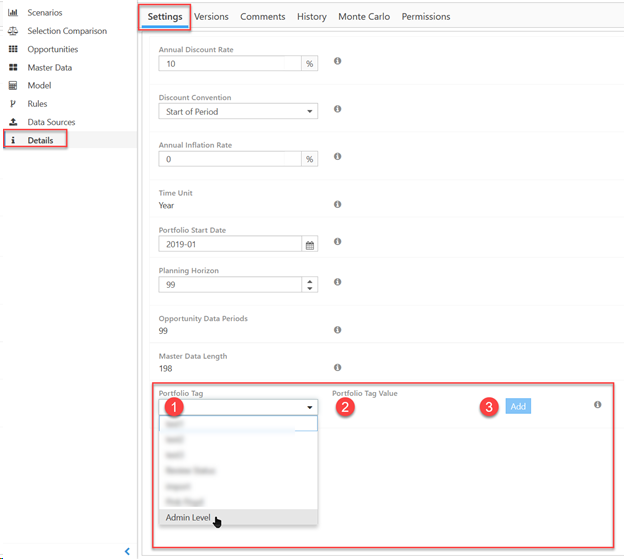

Portfolio Tag

Administrators can configure Portfolio-level tags that are displayed on the Portfolio Landing Page.

The tags allow users a way of identifying Portfolios for review or other purposes.

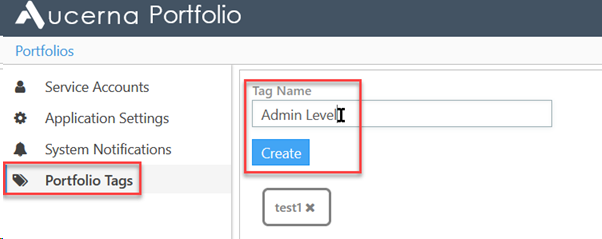

Administrators create one or more optional tags in Portfolio Admin Settings.

Users populate tag values in Portfolio Settings.

- Select the pre-defined tag from the Portfolio Tag drop-down.

- Type in a new tag value or select a previously used value.

- Select the Add button to add the tag to the list.

Tag values are visible in the Tags column on the Portfolios (Home) Page.